We are now emerging into a third season of DePINs. The first season was entirely Helium, demonstrating how token incentives could drive the rapid build out of a global network. The second season was marked by the explosion of follow-ons like Hivemapper, DIMO, and WeatherXM, all of them using the core concept of decentralized physical infrastructure networks.

The third season begins now with the results from early incentive explorations.

In this post, we’ll break down the lessons from two of the largest hex boosting projects—GEODnet and Helium Mobile—and show you how to avoid costly mistakes.

For founders building DePIN projects, understanding how to adapt these strategies is key to success. Get it right and hex boosting can be incredibly effective, using well-designed incentives to target specific locations.

Miss just one key piece and you risk wasting resources and eroding trust with your community.

What Is Hex Boosting?

Hex boosting is the idea of incentivizing specific locations to encourage miner deployments. Simple in concept (you earn more if you put a miner inside a specific location), the design must be customized to the needs of the each network.

Over the past year, Gold Hawks has been deeply involved in two of the largest hex-boosting efforts: GEODnet, where we wrote the “Superhex” protocol, and Helium Mobile, where my partner Max Gold played a key role in designing their hex boosting rules.

Both GEODnet and Helium Mobile aimed to attract miners to specific areas, but their requirements, approaches, and outcomes differed drastically. GEODnet’s hex boosting protocol is widely considered a success, while Helium Mobile’s faced significant challenges.

By examining these two projects, we’ll help you identify the key factors that determine whether hex boosting thrives or fails.

The Impact of Hex Size: Deployment and Cost Considerations.

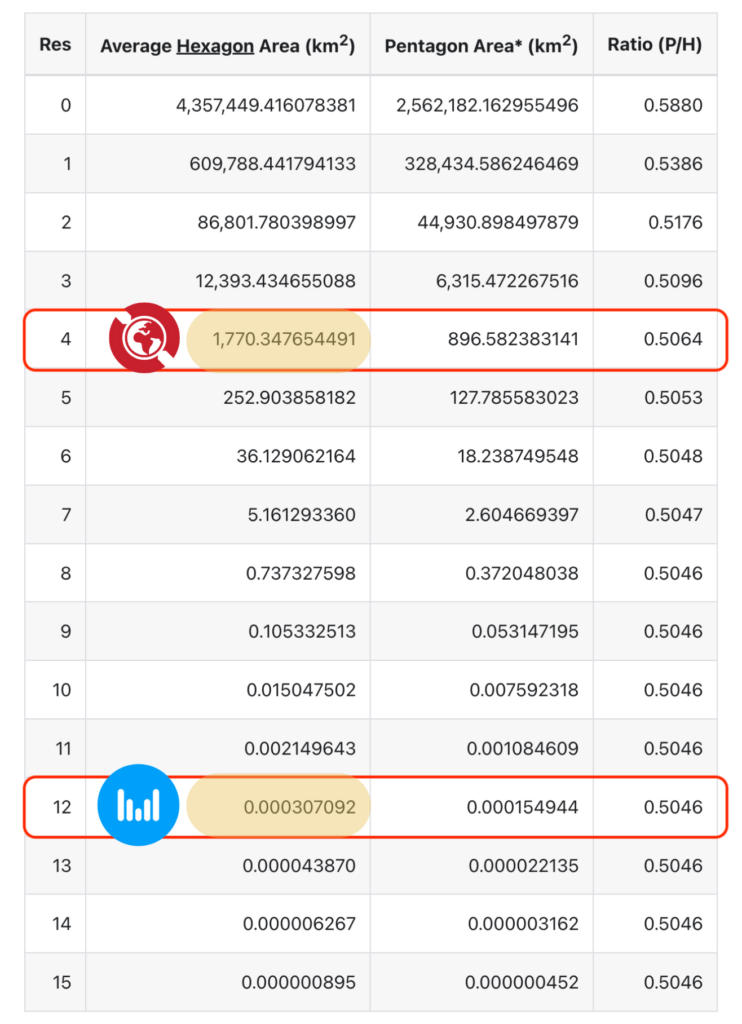

First, the size of the hex you boost makes a difference in how much it’ll cost you in tokens to cover it. GEODnet used res4 hexes.

A res4 hex is about 680 square miles; think of something that can cover the size of New York City, from White Plains down to the tip of Manhattan. Yes, I know White Plains isn’t NYC. A res4 is huge.

A res12 hex is about 3,300 sq ft, about the size of a large house.

They are vastly different sizes.

How does size make a difference? In two ways: Ease of deployment, and cost.

Imagine if I give you the task of putting a thing somewhere in New York City. You have a TON of options. You could call your Aunt Betty, your Uncle Harry, your friend Sam, your old locker-mate’s dog walker’s friend Billy, or any one of a hundred people you know there.

If, on the other hand, I task you with putting a thing into an area the size of a specific building in New York City, well, it’s pretty unlikely you know anyone in that building, never mind getting permission and sorting out compensation.

The smaller the area you need (the more precisely accurate the target), the more costly in tokens it’ll be for the project.

It’s not just the tokens at stake—it’s the actual money spent by the deployers.

Deployers have to pay a variety of costs, from advertising to find locations, to cold calling, to going door to door, or getting compensated for the time to negotiate deals and secure agreements.

They’re looking for durable sites, ones that have enough margin to weather a bear market. Those aren’t easy to find.

Higher token rewards for specific sites need to reflect those higher costs.

Determining Market Price – Reverse Dutch Auctions

Helium Mobile offered a 100x reward to place a miner in a precise spot. For GEODnet, we built a reverse Dutch auction (RDA) that never gave higher than a 14x multiple.

Using a reverse Dutch auction once you’ve identified an area as generally valuable allows the market to determine the specific value of the area. There’s no need to guess at what a location might cost to deploy into; let the genius of the market do it for you.

An RDA has the additional benefit of putting pressure on deployers to deploy as soon as possible for fear that someone else will beat them to it and claim the multiplier.

The Impossible Problem: Proof of Location

While hex size and the cost of deployment played crucial roles, there was another significant factor that can make or break a hex boosting strategy: The ability to verify miner location.

Without accurate location tracking, Helium Mobile (and any DePIN that isn’t a native location provider) is susceptible to location spoofing to gain unearned rewards. GEODnet has an unfair advantage here as a GNSS project, and wisely played to it.

GNSS and WiFi/CBRS are different animals.

A GNSS base station can provide coverage up to 20 km away from the station (you can do this with Onocoy if you already have a base station and want to participate in a GNSS project.)

WiFi/CBRS will reliably go out to about 300 feet, which means Helium Mobile had to be far more precise with locating a station.

The Hazards Of The Impossible Problem

If you can’t unequivocally prove your location, it is much easier for cheaters to deploy a miner and earn the 100x rewards at the cost of not actually delivering the coverage they needed to deliver.

Boosting based on modeled coverage (which was what Helium Mobile did) only compounds this issue.

When you rely on what a deployer tells you they can cover, you’re extending trust in a trustless environment. There’s no real way to verify if they’re providing the intended service. It’s one thing to claim coverage from the first floor of a building, and another to actually be providing it from the roof—without verification, there’s no distinction.

Projects like Helium Mobile, which depend on precise location accuracy, cannot afford to base rewards on unverifiable modeled coverage. This fundamental flaw not only opens the door to cheaters but erodes trust within the network.

The Road Ahead

With all that as background as to how each project approached and executed their strategy, what will the next season of DePIN look like?

Helium Mobile’s Next Move

Helium Mobile should pivot away from location based rewards to a more usage based rewards system.. This could be through actual customers or an app to that use alternative proxies for network usage to simulate potential future value of a location.

At scale, an app that allows users to verify hotspot connectivity in real-world locations could help ensure that coverage is genuinely being provided.

The key to making this approach effective is scale. If only a small number of users participate, the system becomes easy to game—for instance, a bad actor could deploy 100 phones to fake usage, a tactic we’ve seen in other DePINs.

With a million active users, the system becomes much harder to manipulate and the value of a location can be determined by actual foot traffic rather than arbitrarily assigning a boost multiple of 75x or 100x.

Of course, it wasn’t all bad with Helium Mobile. The move to hex boosting gave utility to the token along with generating onboarding fees for all the miners that rushed to fill in boosted hexes.

Lessons From GEODnet

Fundamentally, GEODnet had an advantage in that proving location is what they do. When writing their SuperHex system, we used that inherent strength combined with the time-pressure incentive of a reverse Dutch auction and the clustering bonus to fill all 91 of the initial SuperHexes identified.

As Mike Horton, founder of GEODnet, says on their website,

“The SuperHex Phase I program was launched in Nov 2023. It was a success.“

Stacking Techniques: Hex Boosting + Cluster Incentives

Redundancy is key in high-value areas. With GEODnet, the first to place a miner got the full multiplier, but the second and third miners to deploy in that hex also earned half of the boosted reward.

This cluster incentive on top of hex boosting was no accident. These areas were chosen as SuperHexes because they had a high likelihood of generating revenue.

Losing a station to an outage in one of these revenue-generating locations is more detrimental to the network than overpaying for redundant coverage. Building in redundancy ensures that service in high-value areas is reliable.

We’ve covered the power and proper use of clustering incentives in a previous article.

The lessons from GEODnet and Helium Mobile are clear:

- Customize your incentive systems to match the specific needs of your network, considering factors like hex size and deployment costs.

- Use market-driven solutions, like clustering incentives or reverse Dutch auctions, to avoid overpaying for coverage and to encourage quick deployments.

As we move into the next season of DePIN, use the lessons of history to increase the chances of success for your project and your community. If you need expert guidance, we stand ready to assist.

Rock ‘n roll!

Gold Hawks & Associates LLC is a consultancy specializing in the DePIN space. We have been featured in Forbes, Fortune, and Messari and have worked with all sizes of projects including Nova Labs, Helium Foundation, Hivemapper, IoTeX, Anode Labs, Onocoy, GEODnet, WiFi Dabb, Anyone (formerly ATOR), WeatherXM, Threefold, and Eclipse Labs among others.

We assist with strategy, incentive design, and messaging. Whether you are considering starting a DePIN project or you’d like help managing your success, we stand ready to assist. Please reach out if you’d like our expertise applied to your project.

Disclaimer: Financial Interests and Consulting Services Disclosure

This blog post may contain references to various cryptocurrency projects, tokens, or assets. It is important to note that the authors of this blog post and Gold Hawks & Associates may have a financial interest in some of these projects or may provide consulting services to them, or in some cases, both.

The information and opinions expressed in this blog post are intended for informational purposes only and should not be construed as financial advice or a recommendation to invest in any specific cryptocurrency project. Readers are encouraged to conduct their own research and seek the advice of qualified financial professionals before making any investment decisions related to cryptocurrencies or any other financial assets.

The authors and Gold Hawks & Associates are committed to providing accurate and unbiased information, but it is essential to understand that our financial interests or consulting relationships with certain projects may influence the content presented. We aim to maintain transparency and integrity in our content, but readers should exercise due diligence and consider potential biases when interpreting the information provided.

Investing in cryptocurrencies involves inherent risks, and market conditions can change rapidly. It is crucial to make informed decisions and only invest funds that you can afford to lose. The authors and Gold Hawks & Associates assume no responsibility for any losses or damages resulting from actions taken based on the information presented in this blog post.

By reading and engaging with this content, you acknowledge and accept the potential conflicts of interest disclosed in this disclaimer.

Leave a Reply