How can onboarding fees help your DePIN project?

This post is part of a series exploring the DePIN Incentive Cycle. Our goal is to help you understand the various tools and strategies that a project can use to navigate the complexities of this new form of business.

Let’s start the discussion of onboarding fees by taking a quick detour into mindset. Placing DePIN projects within a crypto substrate primes them for exponential growth. In other words, building in crypto is for projects willing to saddle up a dragon.

This is more sedately referred to by Multicoin Capital, one of the largest web3 venture capital firms out there, as “[the ability to] build infrastructure faster”.

Multicoin lists this first when they explain their Proof of Physical Work investment thesis in their Exploring The Design Space of DePIN Networks and Proof of Physical Work pieces.

10x to 100x ain’t incremental growth. How should founders prepare for this explosion in infrastructure growth?

One way is through onboarding fees.

Onboarding fees are fees that are charged to add a device (onboard it) to the network. Not all projects have them, although in the main we believe they should.

Onboarding fees are a superb example of shifting utility in a token. When a network is small and unable to provide network-effect service, it needs a reason to have a token.

Shifting Utility

By requiring a token payment to onboard a device, onboarding fees create token utility very early in the life cycle. This helps get a project through the cold-start phase. Once the network is large enough to provide a useful service, the token will shift to a new utility by being the gateway to that service.

What happens when there is no utility for a token? Let’s look at the Pollen project and the PCN token. Pollen was a 5G network where deployers bought and set up small cell radios and received tokens for providing coverage. You couldn’t do anything with the token other than buy or sell it.

After a first spike in initial excitement, the token price steadily dropped. There was nothing to do with the token other than hodl and hope that when the music stopped there was a chair left for you. By January of 2023, there were no more chairs. The Pollen team rugged, and the project, at least as a crypto DePIN, was dead.

Now, this is not to say that onboarding fees are a panacea; they are simply ONE part of a well run project.

How Do Onboarding Fees Work?

How do onboarding fees work, and what are the nuances of correctly used onboarding fees?

Let’s start at a high level.

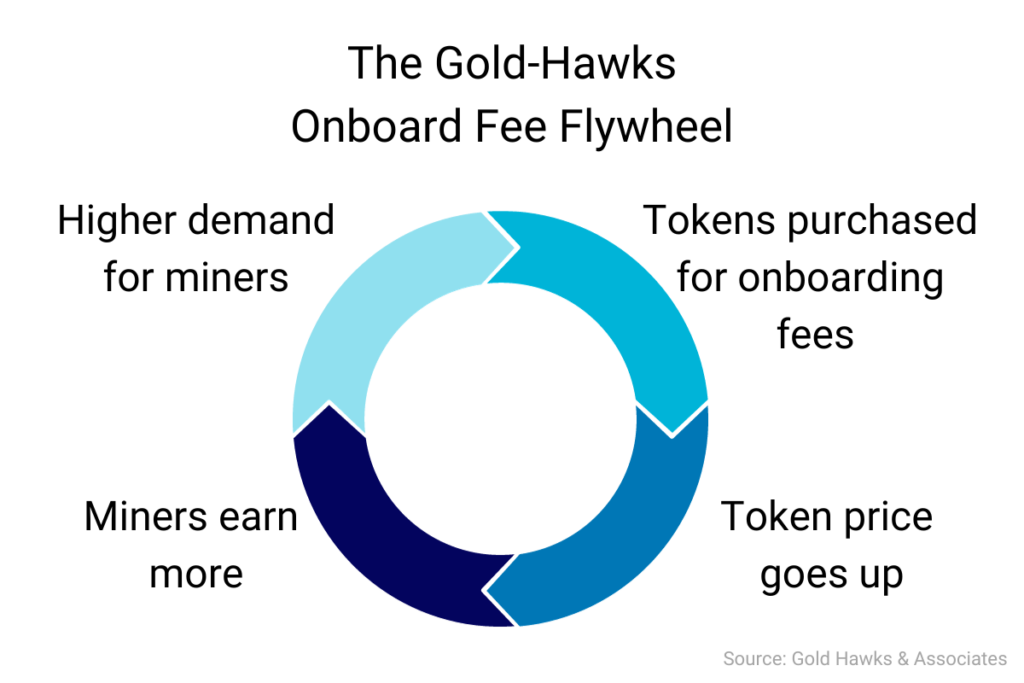

In order to add (onboard) a miner to the network, a fee paid in tokens must be made. Tokens are purchased to pay this fee. As more miners are deployed, more tokens are bought for onboarding fees. As more tokens are purchased, the token price goes up. As the token price goes up, the return on buying a miner improves, and more people buy miners, which have to be added to the network.

In economics, this is known as a positive feedback loop.

Since thousands (if not hundreds of thousands) of devices need to join the network, the amount of tokens bought and burned to cover onboarding fees creates revenue for the network in early days and drives up the token price.

Remember, the network doesn’t care what the source of revenue is. In the long term, revenue should come mainly from services provided by the network. In the short term, that won’t happen.

This brings us to an important point: Onboarding fees should NOT be charged to the individual. Onboard fees should be paid by the manufacturer.

Why? Two reasons:

First, a DePIN project is an entry point into crypto for many. The less friction there is for them to start deploying the network, the better. Requiring people new to crypto to figure out which wallet app they need, set it up, realize that their USDC is on Ethereum and not Polygon, buy some ETH and try to bridge it over, lose some of it trying to bridge, get some MATIC, find out the price has changed and now they need more USDC so they can swap it on some DEX for an unknown token…all just so they can onboard their new device adds unnecessary friction.

It’s a mess and a waste of resources to force people to learn how to do this before they can even set up their device on the network. Get ’em on the network, get ’em contributing and earning, THEN let them sort through the crypto/fiat interaction.

Second, manufacturers set the pricing for the hardware. Building in fees is an ordinary part of business for them. Manufacturers are used to building in all the costs required to get a device into a consumer’s hands; parts, labor, line setup, shipping, distribution, etc. Adding in one more cost is asking a duck to shed one more drop of water.

I know what you’re thinking: Higher hardware costs mean less deployment.

It’s actually the opposite. The economic effect of manufacturers needing to buy and burn tokens far outweighs any increase in cost from onboarding fees, as long as those fees are kept to something reasonable (call it 10% of the cost of hardware.)

Remember, we can pretend that your deployers care about the technology the project is built on. To a small degree, it’s not pretend; there are LoRaWAN and RF and mobility data and mapping nerds out there who love the tech.

Make no mistake: The majority of deployers in a DePIN are joining your system to benefit financially.

Now, we mentioned above that this onboarding fee flywheel is a positive feedback loop. Those can be really exciting, but can also get out of control.

This onboarding fee flywheel will get a little hairy. It’s part of the reason we started the article talking about exponential growth and your mindset as a founder. Exponential growth isn’t something anyone casually saddles up and rides on. It’s a flat out fire breathing red dragon that will buck you off at the first opportunity.

It’s also a way to build a bigger network faster than anyone else.

So, one of your decisions as you consider entering the DePIN space should be:

Will this project benefit more from a slow and manageable build-out that will end up with a small number of nodes, or is it better to fly over (and probably off) the hump, temporarily have a much larger network than is sustainable, then settle back into a healthier number that is still larger by an extra zero than anything that could be built with the slow/sustainable model?

If you’re not looking for exponential growth, you’re in the wrong model. When this flywheel starts in a bull run, the team that thinks about how to come out the other side with a bigger product than anyone has ever seen is the team with the right attitude.

This idea of shifting utility was one of the main drivers for Helium HIP 96, which we wrote and you can find here. If you’d like our help to improve your project, reach out.

LFG.

Disclaimer: Financial Interests and Consulting Services Disclosure

This blog post may contain references to various cryptocurrency projects, tokens, or assets. It is important to note that the authors of this blog post and Gold Hawks & Associates may have a financial interest in some of these projects or may provide consulting services to them, or in some cases, both.

The information and opinions expressed in this blog post are intended for informational purposes only and should not be construed as financial advice or a recommendation to invest in any specific cryptocurrency project. Readers are encouraged to conduct their own research and seek the advice of qualified financial professionals before making any investment decisions related to cryptocurrencies or any other financial assets.

The authors and Gold Hawks & Associates are committed to providing accurate and unbiased information, but it is essential to understand that our financial interests or consulting relationships with certain projects may influence the content presented. We aim to maintain transparency and integrity in our content, but readers should exercise due diligence and consider potential biases when interpreting the information provided.

Investing in cryptocurrencies involves inherent risks, and market conditions can change rapidly. It is crucial to make informed decisions and only invest funds that you can afford to lose. The authors and Gold Hawks & Associates assume no responsibility for any losses or damages resulting from actions taken based on the information presented in this blog post.

By reading and engaging with this content, you acknowledge and accept the potential conflicts of interest disclosed in this disclaimer.

Profoundly insightful article on the DePIN space. The article underscores Nik and Max’s deep understanding of the multifaceted components necessary to propel a project to the next stage of development.