Max & I have always taken for granted that the “payback period”, commonly and incorrectly called ROI (for Return On Investment), is what drives miner sales in DePIN projects. The Payback Period is calculated at its simplest through dividing the cost of the miner by it’s daily earnings.

Obviously that simple calc has a few flaws and nuances, not least of which is the variability in the denominator.

Many potential buyers do a slightly more complex calculation:

- How much does the miner cost?

- How many tokens could I buy with that money right now instead?

- How long would it take me to earn more tokens mining vs just buying them?

If there appears to be an edge for mining, they buy a miner. If not, they don’t, and anecdotally, they usually don’t buy tokens, they just look for an edge somewhere else.

Miners need a fast ROI not only because they want money fast, but because of the uncertainty of these projects. If the token price changes, or, as we’ll show later, rewards are reduced by other entrants into the project, the payback period can change dramatically.

This rough calculation is how the majority of miners we’ve met and interacted with* assess whether or not they’ll get involved. This includes singleton miners who are just dipping their toe in all the way out to large miner fleets managed professionally.

Still, we’ve met a few people in the DePIN world who aren’t convinced.

They’ve believed variously that interest in the technology, or “momentum”, or how much media cover a project gets are prime movers in sales. For many founders, it’s temping to think that their view of the world is everyone’s view. That’s not always true.

Founders are tech nerds and are in love with their technology. While that’s fine (and in fact, a desired trait), mistaking YOUR love for the tech and why MINERS are deploying can be deadly to your project.

Momentum and media coverage are the results of improving payback periods. It doesn’t work the other way around. Let’s take a look at a DePIN dataset for Helium, which is the largest and longest lived DePIN so far.

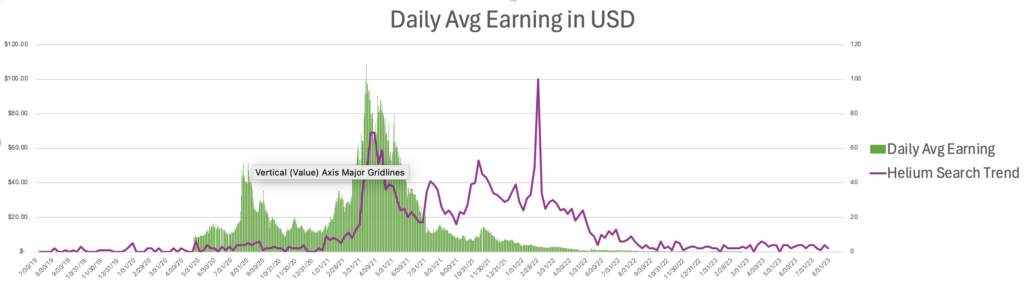

We’ll start with charting Google trends for “Helium Hotspots” against the average daily earning of a Helium Hotspot in USD.

Much of the Helium related data in this article (number of hotspots online and active on both the original Helium blockchain as well as Solana) was generously provided by HeliumGeek; check out their work here.

You’ll see (you may have to squint, all data available here) that the search trend trails the price just slightly.

We think the reasonable interpretation is that the price goes up, then people see that, then the media pays more attention and momentum builds.

Now, it’s not like we’re doing anything particularly groundbreaking in overall economics. The Arrow-Debreu model of Competitive Equilibrium laid out in a paper published in Econometrica in 1954 that a set of prices exist where supply will equal demand. In Helium, as the price went up, the demand skyrocketed. Manufacturers couldn’t keep up with demand, and there was a delay of up to 6 months in shipping units. At the peak of demand, Helium Hotspots were selling on eBay for $10,000.

The connection between revenue generation and cost of asset purchase exists across multiple industries.

A ton of academic work tying hardware sales to potential returns has already been done. Whether it’s in the prestigious journal Nature, where Ansari and Kaufmann explored how the purchase of drilling rigs in the gas and oil business is affected by future prices, or Professor Dean Fantazinni at the Moscow School of Economics writing “Does the Hashrate Affect the Bitcoin Price?” for the Journal of Risk and Financial Management, this is a topic that has been researched extensively.

Still, Arrow-Debreu is definitely Traditional Economics and we’re out on the cutting edge of Complexity Economics, so while it’s important to build on history, it’s equally important to push out the edge of knowledge, which is where the DePIN space is.

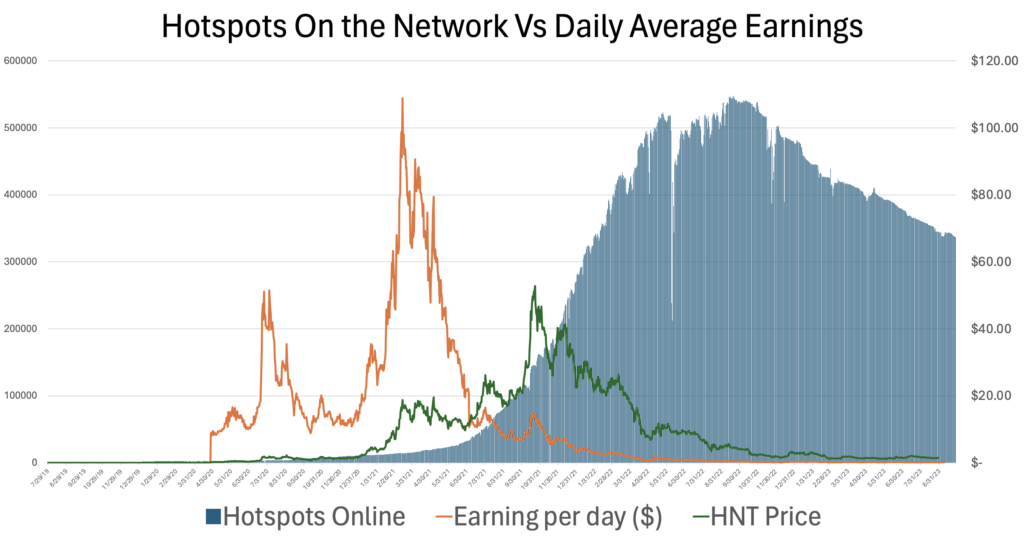

Let’s take a look at another chart, this time tracking the number of Helium Hotspots added to the network (orange) against the price of HNT (green). We’ll talk later about how many Hotspots stayed on the network, but for now we’ll just use the total Hotspots added.

It’s a smooth curve that, around day 600 (mid April, 2021) starts to inflect up.

As you can see. around day 550 (early March of 2021) the price jumps, but it’s not until around 150 days later that the number of onboard really starts to rise. We believe that time delay is a function of manufacturers being unable to ship hardware quickly due to a global chip shortage.

The interplay of consumer demand, onboarding fees, manufacturer distribution and the accompanying time delays in the Helium cycle to date matches up with textbook patterns.

The Importance of Being Early (for Miners)

In the beginning of Helium, “the Network targeted the distribution of 5,000,000 HNT per month at launch.” That HNT was distributed to out to basically 2 segments: Miners and Investors, with 35% going to investors in year one and that slice reducing over time.

I’m glossing over some details here, like the Consensus segment and how segments for mining and data transfer were combined. The upshot is that all rewards were basically split into two large reward pools: Miners and Investors.

In the first year of existence, the Miner pool was about 3,250,000 HNT per month.

That amount was split between all Hotspots on the network. If 200 Hotspots were on the network, then on average each Hotspot would earn (3.25 million divided by 200) 16,250 HNT/month or about 540 HNT/day.

As more Hotspots came on board, that same amount (3.25 million HNT/month) was split between all of them, including the huge influx of newcomers. The splits got smaller and smaller over time as more miners joined.

For miners, it paid hugely to be as early as possible. By the time the network was actually useful from a LoRaWAN perspective (arguable, but let’s say 20,000 Hotspots at the low end) the crypto mining profits were mostly gone.

The blue hump is the number of Hotspots online, which rose and then fell as the price dropped off and deployed Hotspots were no longer worth keeping online.

This last graph is a superb example of what a pretty successful business experiment looks like.

It’s become popular to think of Helium as some kind of failed project because they didn’t get everything exactly right and the number of Hotspots online is declining.

Keep in mind that Helium built the largest LoRaWAN fleet in the world in just under 50 months, and most of that within a 24 month period. They are STILL 3 times larger than the next largest LoRaWAN.

Helium showed the rest of us the extraordinary power of a DePIN.

Now that the light has blazed, our collective responsibility is to explore this new view of the world and see where best to apply the groundbreaking work they’ve done.

In following articles we’ll be exploring just how much was illuminated, and how to use what we’ve learned to stand on the shoulders of giants and peer yet further.

LFG!

* Regarding the number of miners Max & I have met and interacted with, I spent most of 2021 running a very profitable business consulting for hundreds of miners in Helium and writing the Gristle King blog, which got over 60,000 visitors per month. During that same time Max was flying around the country building the highest performing fleet in Helium, with over 800 miners across the US. It’s reasonable to assume that we built an accurate picture of what miners were thinking across all levels of involvement, from singletons out to commercial fleets.

Gold Hawks & Associates LLC is a consultancy specializing in the DePIN space. We have been featured in Forbes, Fortune, and Messari and have worked with all sizes of projects including Nova Labs, Helium Foundation, Hivemapper, IoTeX, Anode Labs, Onocoy, GEODnet, WiFi Dabb, Anyone (formerly ATOR), WeatherXM, Threefold, and Eclipse Labs among others.

We assist with strategy, incentive design, and messaging. Whether you are considering starting a DePIN project or you’d like help managing your success, we stand ready to assist. Please reach out if you’d like our expertise applied to your project.

Disclaimer: Financial Interests and Consulting Services Disclosure

This blog post may contain references to various cryptocurrency projects, tokens, or assets. It is important to note that the authors of this blog post and Gold Hawks & Associates may have a financial interest in some of these projects or may provide consulting services to them, or in some cases, both.

The information and opinions expressed in this blog post are intended for informational purposes only and should not be construed as financial advice or a recommendation to invest in any specific cryptocurrency project. Readers are encouraged to conduct their own research and seek the advice of qualified financial professionals before making any investment decisions related to cryptocurrencies or any other financial assets.

The authors and Gold Hawks & Associates are committed to providing accurate and unbiased information, but it is essential to understand that our financial interests or consulting relationships with certain projects may influence the content presented. We aim to maintain transparency and integrity in our content, but readers should exercise due diligence and consider potential biases when interpreting the information provided.

Investing in cryptocurrencies involves inherent risks, and market conditions can change rapidly. It is crucial to make informed decisions and only invest funds that you can afford to lose. The authors and Gold Hawks & Associates assume no responsibility for any losses or damages resulting from actions taken based on the information presented in this blog post.

By reading and engaging with this content, you acknowledge and accept the potential conflicts of interest disclosed in this disclaimer.

Great deep dive. Good information for the next time around.